This account doesn't earn at the most competitive interest rate. It's important to double check your exact interest rate, too, since the bank's rates can change by location. You do have the opportunity to boost your rate slightly by linking a PNC checking account to your savings account. You will also have to set up a qualifying monthly direct deposit to the linked checking account or make at least five qualifying purchases each month with your debit card or PNC Visa® credit card. Be sure to check your agreements to know exactly what you need to do to snag the rate boost.

PNC offers two savings options in the Virtual Wallet bundle. Customers in certain regions may qualify for higher rates on their Growth accounts, and might be eligible to apply for PNC's online savings account, which also comes with a higher annual percentage yield. Even PNC's premium accounts allow you to waive fees through direct deposit, a policy most banks don't follow. In addition, the saving and budgeting tools add a way to organize your finances with the Virtual Wallet account package. A few other banks also package checking and savings accounts together, but PNC's Virtual Wallet actually provides tools to help you use the accounts together in a logical way.

Convenience is the main appeal of the PNC Virtual Wallet since you can easily get checking and savings accounts packaged with one application and less hassle. The online and mobile money management tools appeal to those who want to track their money and transfer funds without needing to rely on third-party apps or websites. The overdraft protection available with the secondary checking account and savings account offers some peace of mind along with warnings that can help you avoid declined transactions and overdraft fees. Despite the benefits, some customers may feel frustrated with the account fees and the inability to open just a savings account with the Virtual Wallet product options available. Unless your account waives it, the monthly service fee can range from $7 to $25 where there are other banks that have fee-free checking and savings accounts that appeal to frugal customers.

Plus, there are ATM fees that you might incur beyond the monthly waivers and allowances. While you can opt just for a Virtual Wallet checking account, you'd need to look into other PNC products simply for savings and miss out on some of the Virtual Wallet benefits in the process. All PNC checking account customers get a PNC Bank Visa Debit Card and the surcharge-free use of thousands of ATMs. There is also reimbursement of some non-PNC ATM fees, free online banking and mobile banking and higher interest rates on savings as you build your balances. With the PNC Mobile app, you can deposit checks, make cardless ATM transactions, find nearby ATMs, check your balances, set up account alerts and more. Here you will find useful instructions on how to create PNC online banking my.

Unfortunately, PNC Bank doesn't allow you to complete wire transfers online. Or take your Mcard to any PNC branch, or call PNC-1000. You can also go to your online PNC account and under "customer service" tab, select " Link campus ID Card". – You can then use your Mcard to access your PNC account at ATMs and to make debit card purchases at stores with the use of your PIN. American Express offers world-class Charge and Credit Cards, Gift Cards, Rewards, Travel, Personal Savings, Business Services, Insurance and more.PNC's Virtual Wallet . Virtual Wallet is an online tool that helps you navigate and control your finances.

The Reserve account APY is 0.01 percent on balances $1 and higher; the standard APY on the Growth account is 0.01 percent. "Relationship rates" are 0.02 percent APY on balances up to $2,499.99 and 0.03 percent APY on $2,500 and above. To qualify for the relationship rate, you must have at least five PIN or point-of-sale transactions per month using your PNC Visa debit card or PNC credit card, or $500 in qualifying monthly direct deposits. If you don't opt for the Virtual Wallet package and open just a single savings account, your interest rate will drop from the relationship bonus of 0.06% to the standard 0.01%.

As long as you maintain the minimum waiver balance or set up automatic transfers of at least $25 from your checking, you won't be charged a maintenance fee. Most people won't join PNC just for its interest rates, but the bank's options for savings goals and automatic transfer setup can be useful if you need motivation to save. To get access to Citibank's virtual credit card services, you have to log in to your account and select enroll.

Much like DoNotPay's virtual card, Citibank offers short-term VCC accounts that can be used for single transactions only. If you need a virtual card to use for recurring payments, Citibank might not work for you.Capital OneCapital One provides VCC services through its digital assistant called Eno. What is amazing about it is that you can install Eno as a web browser plugin that will automatically pop up during check out and ask you if you want to use a new virtual card for the upcoming transaction.

Keep in mind that setting a maximum charge limit is not available with Capital One's virtual credit cards. Virtual Wallet is a money management tool for tech-savvy consumers with no monthly service charge or minimum balance. Virtual Wallet has averaged more than 3,500 account openings per week this year and has earned numerous awards for design, technology and innovation. To open a Virtual Wallet account requires a minimum deposit of $25, but you can waive that if you open the account online.

Also, there is a monthly service charge of $7 that you can waive by keeping a balance of $500 in your Spend or Reserve accounts, or making $500 in qualifying deposits in a specified time period. If you're 62 or older, you'll continue receiving free checking, although it will go by a different name. Three, Standard Checking customers will be charged a $7 monthly service charge UNLESS they meet the average monthly balance requirement of $500, receive $500 in monthly direct deposits, or are age 62 or older. The new checking account must be opened online using the application link on pnc.com/virtualwallet or at a branch through Sept. 30, 2021. A qualifying direct deposit, defined as a recurring deposit of a paycheck, pension benefit, Social Security or some other regular monthly income, must be made within 60 days and your account must remain open.

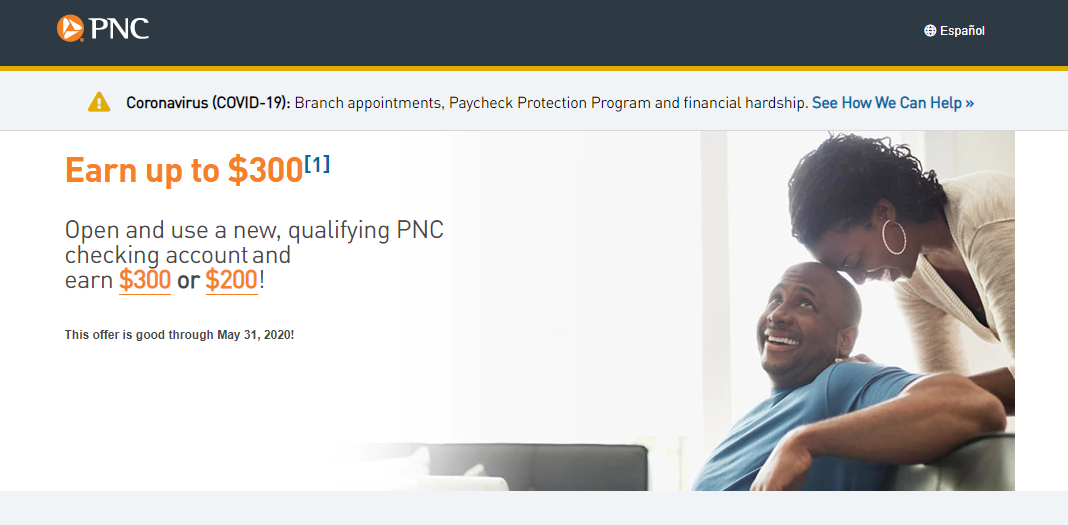

PNC Bank is the seventh-largest bank in the country by assets. Depending on their location, customers can earn up to a $300 sign-up bonus with a checking, short-term savings and long-term savings combo called Virtual Wallet. The trio of products — named Spend, Reserve and Growth, respectively — comes with a nice set of online management tools. But the interest rate on short-term savings is low, and it takes effort to avoid monthly fees on the checking account.

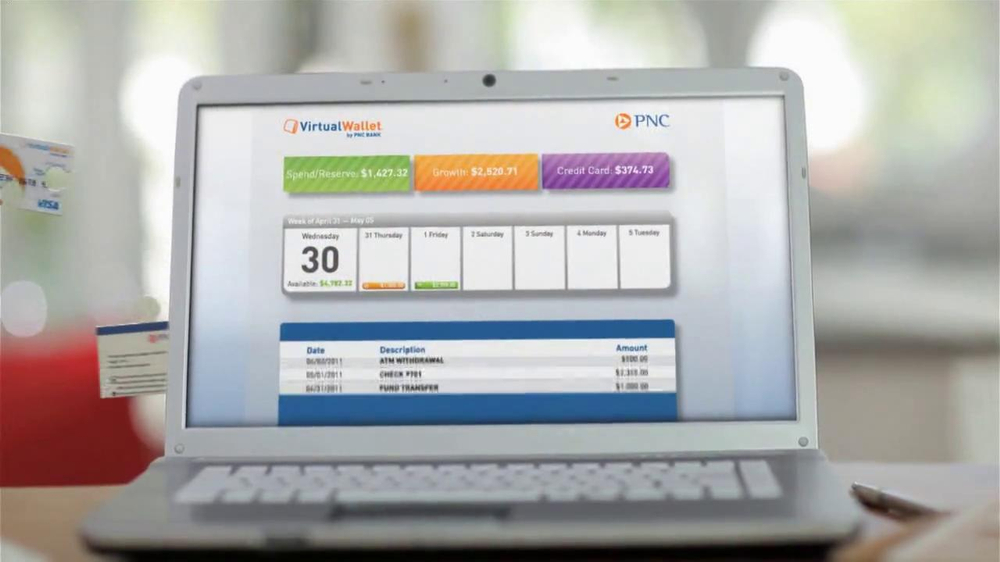

PNC mentions that the fully-featured packages for Virtual Wallet have tools to help you spend, reserve and grow your money. This involves a primary checking account for daily spending, a secondary checking account as reserve funds and overdraft protection and a long-term savings account for growing your money. However, most Virtual Wallet products offered will give you the option to only get a primary checking account to keep things simple. Even with this option, though, you'd still get the online planning, budgeting and tracking tools. Get a $450 welcome bonus when you open your account with qualifying activities.

Must open HSBC Premier checking account through offer page by January 5, 2022, and set up qualifying direct deposits into the new account totaling at least $5,000 per month. Deposit products are offered in the US by HSBC Bank USA, N.A. Member FDIC. All of the accounts included on this list are FDIC-insured up to $250,000.

Note that the interest rates and fee structures for brick-and-mortar savings accounts are subject to change without notice. Product and feature availability vary by market so they may not be offered depending on where you live. Most brick-and-mortar banks require you to enter your zip code online for the correct account offerings. Any return on your savings depends on the associated fees and the balance you have in your brick-and-mortar savings account. To open a savings account, most banks and institutions require a deposit of new money, meaning you can't transfer money you already had in an account at that bank. We also considered factors such as insurance policies, users' deposit options, other savings accounts being offered by the same bank and customer reviews when available.

At a base level, PNC Bank doesn't offer the highest interest rates when it comes to savings accounts. However, there are a couple different ways to save more money with a PNC Bank Account. For one, you can make a larger deposit toward accounts that have balance tiers to earn at a higher interest rate.

Linking certain bank accounts together can also unlock higher interest rates. There are even levels of accounts that you can link so as to get the highest rewards and interest rates. Plus, if you have a high account balance and linked accounts, you'll be earning at the highest rates possible . Virtual Wallet is, simply put, the best online banking system I have ever used. I started with online banking in its early days with a third party system called CheckFree that worked through my bank.

Banks at that time did not offer what we have come to know as online banking. I evolved to standard online banking software through my bank when it became available but opted for Virtual Wallet when it was first offered. It allows me to track all of my funds, plan on payments in the future knowing what funds will be available at that time.

You can place me in the category of being a very satisfied customer. PNC bank is offering up to a $300 bonus for those who sign up for its Virtual Wallet. On top of the bonus, there are no monthly fees with qualifying direct deposit. You can also get bonus rewards when you link your PNC Visa® Credit Cards to your account. PNC Bank's Virtual Wallet with Performance Select checking account is more than just a checking account. It includes one checking , one interest-bearing , and one savings checking account, in addition to a variety of digital tools for better money management.

If you're looking into opening a checking or savings account at PNC Bank, you'll find that the Virtual Wallet product appears as the most popular choice for both general consumers and students. Rather than providing you with just one account, this product comes in different versions where you can get a checking account only or both checking and savings accounts. Virtual Wallet also features tools that can help you set and work toward certain financial goals. Read on to learn more about how PNC Virtual Wallet works, which package options are available and the features, pros and cons involved with this financial product. The PNC Virtual Wallet offers the features of a checking account and savings account rolled into one. It's interest-bearing, comes with ATM access and helps you track your spending through an app.

But interest rates top out at 0.06% and monthly fees could eat into your savings. Sign-up bonuses for deposit accounts – While sign-up bonuses are more common among credit cards and business accounts, PNC offers a sign-up bonus when you open a Virtual Wallet. Depending on the type of account, you can earn either $50, $200, or $300 when you sync your account with a qualifying direct deposit. The 'Spend' function is essentially your primary checking account.

This helps with overdraft protection and upcoming expenses. You can transfer money from 'Reserve' to 'Spend' at no charge. 'Growth' is the third main account, which is your long-term savings account. This can serve as your second line of overdraft protection, but is also perfect for saving for retirement, a car, a home and more. Lastly, you can choose to add a PNC Credit Card to your Virtual Wallet®. This account isn't mandatory or automatically included, but it does provide added perks to your PNC Credit Card.

PNC offers a full range of regular banking products, including checking and savings accounts, credit cards, loans and more. A popular choice is the PNC Virtual Wallet, which lets you manage your money online across accounts designed for checking, saving and investing. PNC also makes this product accessible to customers with different versions that can fit their needs.

The ATM fee reimbursements included with all Virtual Wallet products along with the free wire transfers for certain products can make banking more affordable to more people. Traditional brick-and-mortar savings accounts can be a simple but stable solution for keeping your money secure. They mostly all earn the same interest rate, come with minimum balance requirements and monthly fees. Account holders also have access to their thousands of in-person branches and ATMs, one of the most common reasons why people opt for big banks. PNC Bank offers three different basic checking accounts . To start, the Standard Checking account offers the basics without too many bells and whistles.

You can use your PNC Bank Visa® Debit Card at thousands of PNC ATMs. Plus, you'll receive some reimbursement for non-PNC ATM fees you run into. You'll also have easy and free access to online and mobile banking and Bill Pay and free check writing abilities. You can activate special offers from retailers using online banking or Virtual Wallet, then use your PNC Bank debit card to make the qualifying purchase.

The resulting cash back, usually 2 to 5 percent, will appear in your checking account automatically. Is it time for you to open a bank account for your child? The best bank accounts for kids include features that help you teach them about money management, earning interest, and more.

Here are the details regarding some of the best checking and savings accounts for getting your kids on the path to great money management in adulthood. HSBC has an offer where you can get $450 for eligible new customers who open an HSBC Premier checking account and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months. Credit unions are another option, as long as you meet the membership requirements. Membership requirements are pretty lenient at some credit unions. Bankrate's list of the best credit unions ranks them based on selection of products, APY offerings, mobile features, and associated fees. You can also find high yield checking accounts with APYs of 1 percent and higher at certain banks if you maintain a set minimum balance and meet the requirements for that APY.

While you can get a stand-alone checking or savings account, there's no information online about how to open one. You'll want to spend some time doing your homework before opening an account. Consider combing through the details on the website or speaking to a customer rep to get your questions answered.

If you find PNC's Virtual Wallet products appealing and meet the criteria to get the monthly maintenance fee dropped, it could be worth your while to open an account. Also, if you prefer to bank with a large financial institution with a host of offerings, it might be right for you. This is an interest-earning account, but only for balances of $2,000 and over.

You can also earn cash rewards through the PNC Purchase Payback® program. Other perks include unlimited check writing, design check discounts, free overdraft protection, safe deposit box discount and one free savings or money market account. A certificate of deposit account offers a more structured way of saving. You choose your account term length, make your deposit and then wait for the term to end to access your funds again. Luckily, CDs tend to earn at higher interest rates than regular savings accounts. Typically, the longer the term length, the higher the interest rate.

Currently, Chime offers a credit card that helps you build credit, a checking account, and a savings account that earns a high interest rate. It can take just minutes and save you a trip to a bank branch. The top online banks are FDIC-insured and offer higher rates than typical brick-and-mortar banks, and they often charge low or no fees. The PNC Virtual Wallet is a highly unique bank account that combines a checking account and savings account into one.