Current Terms and Rates 0.01% APY Having a Way2Save® savings account makes saving an easier and more automatic part of your financial habits. You have to link the account to a Wells Fargo checking account to take advantage of two automatic savings options. Your first option is to use the Save As You Go® transfer program. Your other option is to set up monthly or daily automatic transfers in amounts of your choice.

If you're saving monthly, the deposit has to be at least $25, with the daily minimum set at $1. This account allows customers to earn interest on their checking balances over $500. The account owners can order cashier's checks from the bank without any additional fees. Since the typical fee is up to $10, those using cashier's checks often can save significantly.

If you prefer personal checks, you'll also get a $10 discount. Cross-selling, the practice underpinning the fraud, is the concept of attempting to sell multiple products to consumers. For instance, a customer with a checking account might be encouraged to take out a mortgage, or set up credit card or online banking account. Success by retail banks was measured in part by the average number of products held by a customer, and Wells Fargo was long considered the most successful cross-seller.

Richard Kovacevich, the former CEO of Norwest Corporation and, later, Wells Fargo, allegedly invented the strategy while at Norwest. Under Kovacevich, Norwest encouraged branch employees to sell at least eight products, in an initiative known as "Going for Gr-Eight". Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Available to almost anyone with a U.S.-based bank account. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time.

In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement.

Your mobile carrier's message and data rates may apply. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience.

For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply. Get $400 when you open a new eligible Wells Fargo checking account with a minimum opening deposit of $25. Within 150 days of account opening, you must have a total of at least $3,000 each month in qualifying direct deposits for three consecutive months.

Get $250 when you open a new eligible Wells Fargo savings account in branch with a minimum opening deposit of $25. Deposit at least $15,000 in new money within 10 days of account opening. Maintain a minimum daily balance of at least $15,000 for 90 days from account opening. Bonus will be deposited to your new accounts within 45 days after meeting all offer requirements. Open an Everyday Checking account online or bring a bonus offer code to a participating Wells Fargo branch and open an eligible consumer checking account. We also considered factors such as insurance policies, users' deposit options, other savings accounts being offered by the same bank and customer reviews when available.

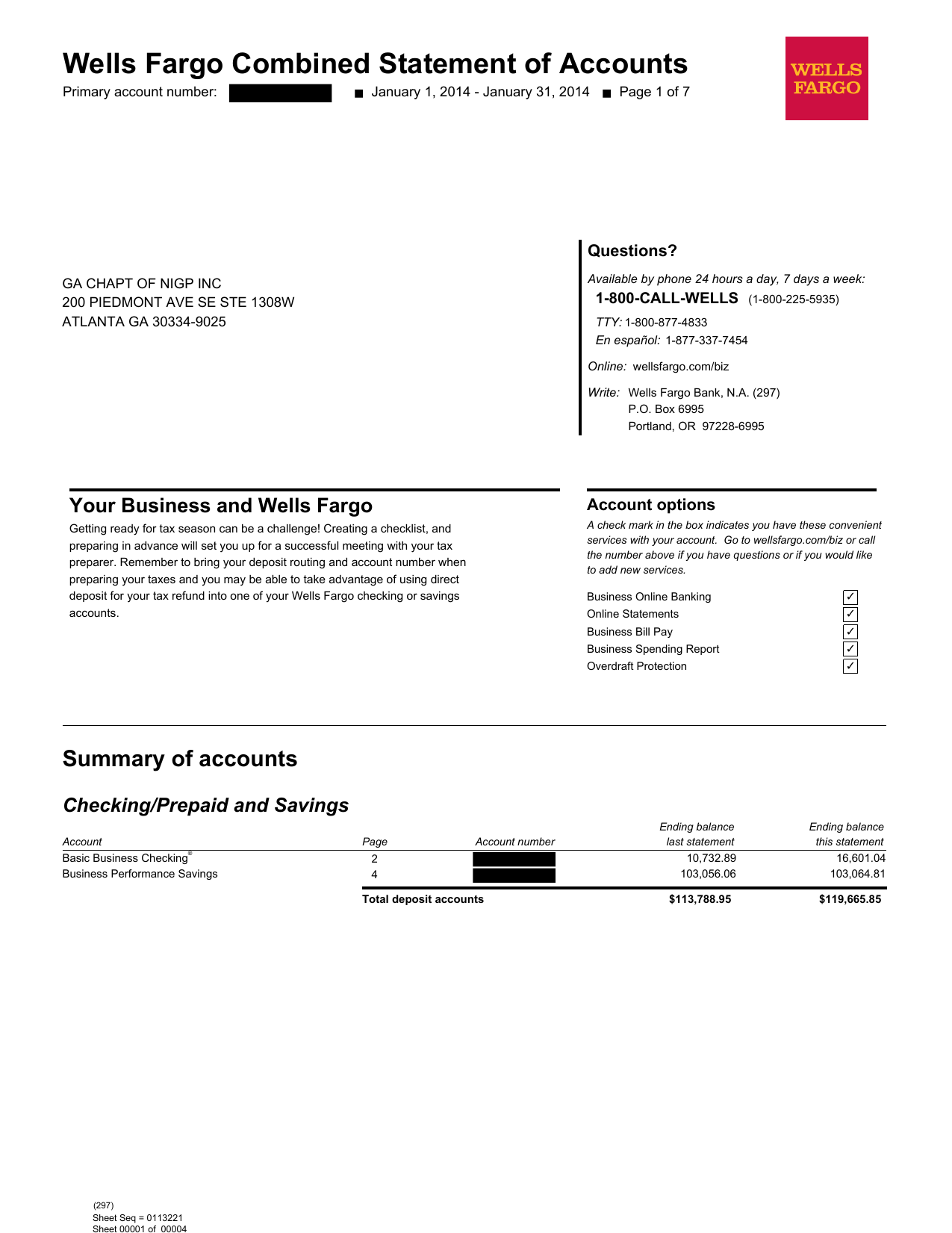

Wells Fargo may consider certain ACH credit transfers to be direct deposits. The other Wells Fargo savings account is Platinum Savings. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period. Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts.

The account even comes with the option to write checks. The account's perks extend beyond the account itself, too. Еhe premium service for eligible customers offers bonus interest rates as well as zero-commission at external ATMs . The account owners get interest on their account balance, earn rewards, receive loan discounts, and are served by the Premier support team.

No fees incurred for Wells Fargo Personal Wallet checks, cashier's checks, and money orders. The monthly $30 fee is waived for those having $25,000 or more in qualifying linked bank deposits, or over $50,000 in qualifying linked bank, brokerage, and credit balances. Premium clients also get an annual Relationship bonus on the non-bonus rewards points they earn with the Wells Fargo Propel World American Express Card. To open a checking account online, you'll have to indicate a zip code for the US city of your residence. That is necessary to show you appropriate offers and prices. You also have the opportunity to open both an individual and joint bank account, so you have to choose a suitable variant.

With a joint account, you and your partner can pay shared household expenses, such as a mortgage, car payments, utilities, and groceries, from the same place. Moreover, joint account funding may help you meet the minimum balance requirements that qualify you for features like waived maintenance fees, a higher interest rate, or additional rewards. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day.

The fee can be avoided if a covering transfer or deposit is made on the same business day. Open an eligible consumer checking account online or bring a bonus offer code to a participating Wells Fargo branch. Within 90 days of account opening, receive a total of $4,000 or more in qualifying direct deposits to your new checking account. After the initial 90 days of account opening, your bonus will be paid within the next 30 days if you have met all offer requirements.

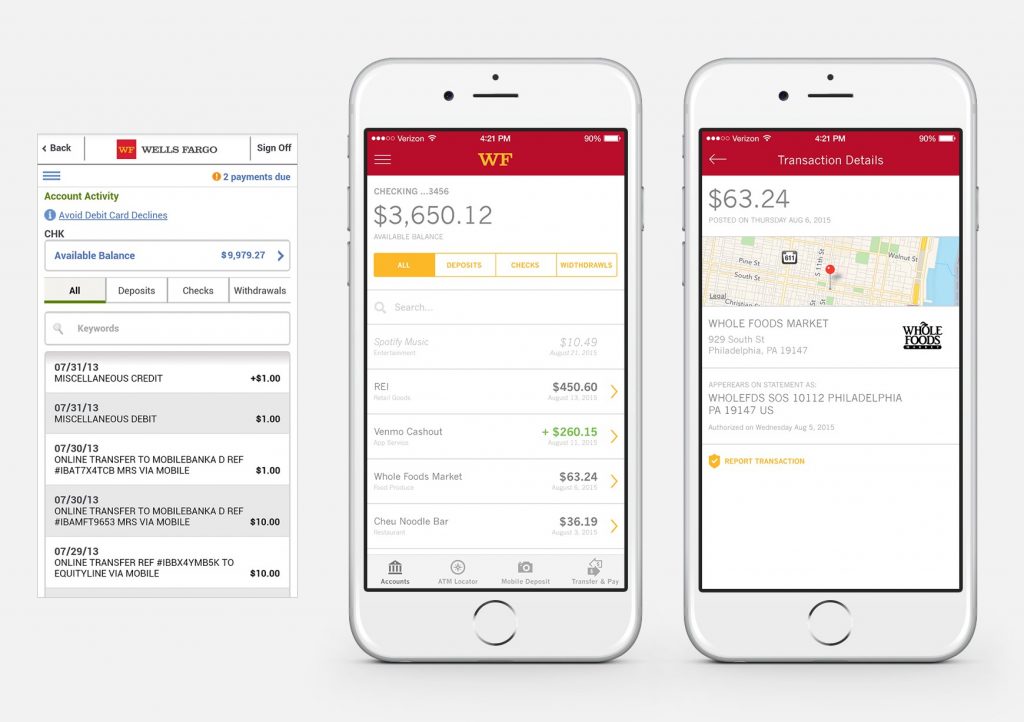

The most popular Wells Fargo checking account has custom text and email alerts to monitor account activities. It's supplemented by a Platinum debit card with chip technology. Unlike Clear Access Banking, this account has a check-writing option. It also brings additional benefits to students if Wells Fargo Campus ATM or Campus Debit Card is linked.

The fee is waived if the owner has a $500 minimum daily balance or $500 and more in total qualifying direct deposits. You can also enjoy a zero service fee if you are 17 through 24 years old or have a linked Wells Fargo Campus Card. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24. Key Features Details Minimum Deposit $25 Access to Your Checking Account Online, mobile, over the phone and at physical branches. Security FDIC insurance up to the maximum amount allowed by law. Fees $3 monthly fee, waivable with online-only statements This Teen Checking account is available to teens from 13 to 17 years old.

The account will need to have an adult co-owner, although both parties will have equal access to the account. Plus, monitoring the account is made easy for both parents and teens with account alerts, online access and mobile banking. Parents can set limits on purchases and withdrawals to help their children learn about responsible spending.

Account holders will also have access to My Spending Report with Budget Watch which works to help customers develop budgeting skills with free money management tools. Gives customers unlimited branch and ATM withdrawals and the option to write checks. It's FDIC-insured up to the maximum applicable limits. Optional overdraft protection for your checking account is another benefit. The account is better suited to those having higher savings goals. Thus, the monthly service fee of $12 is waived when you maintain a $3,500 minimum daily balance each fee period.

Customers can use a debit card with contactless and chip technology instead, pay bills online, and make digital payments. Mobile deposit is only available through the Wells Fargo Mobile app. $5 monthly service fee is waived for primary account owners 13 to 24 years old, although teens 13 to 16 need an adult co-owner. Open a new Everyday Checking account online or in branch.

Receive a total of $1,000 or more in qualifying direct deposits to the new checking account within 90 calendar days from account opening . $200 bonus will be deposited to the account within 30 days after the qualification period. This offer is for new checking account customers only.

All of the accounts included on this list are FDIC-insured up to $250,000. Note that the interest rates and fee structures for brick-and-mortar savings accounts are subject to change without notice. Product and feature availability vary by market so they may not be offered depending on where you live. Most brick-and-mortar banks require you to enter your zip code online for the correct account offerings.

Any return on your savings depends on the associated fees and the balance you have in your brick-and-mortar savings account. To open a savings account, most banks and institutions require a deposit of new money, meaning you can't transfer money you already had in an account at that bank. This checking account is for customers with substantially higher account balances. While a high balance isn't required to keep your account, it allows you to earn at a higher interest rate and have the account's high monthly fee waived. Account balances of $250,000 or more also waive fees for incoming wires, stop payments and ExpressSend remittance services, and receive unlimited reimbursement for non-Wells Fargo U.S. ATMs .

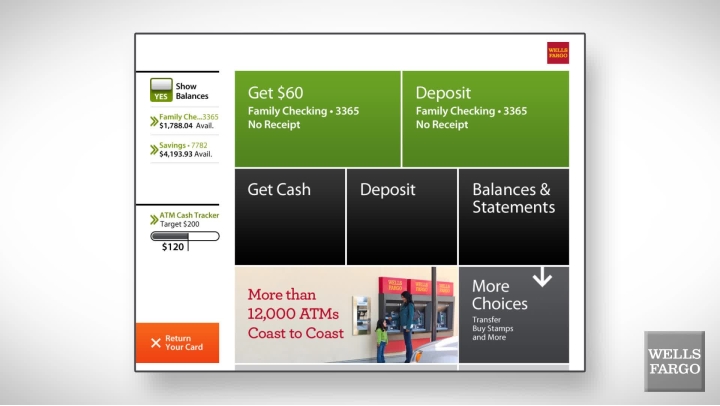

Wells Fargo offers to check and savings account options to both resident and non-resident foreigners. The accounts can usually be linked to a debit card or an ATM card – giving you quick access to cash – and can be managed online, as well as at ATMs. However, those who reside within the US have the advantage of opening their accounts online, which is a great benefit while pandemic health concerns still occur.

Non-residents would have to visit one of the bank's numerous branches in person. Wells Fargo Everyday Checking is Wells Fargo's most popular account for day-to-day banking. The account comes with access to Wells Fargo Mobile app, a debit card with chip technology, budgeting, cash flow and spending tools, online bill pay and 24/7 customer service. Account holders also have access to the Zelle peer-to-peer payment platform. Open a new Everyday Checking account with a minimum opening deposit of $25.

Set up and receive a monthly cumulative total of $3,000 in qualifying direct deposits into your new account for 3 consecutive months. Your $400 bonus will be deposited to your account within 45 days after completing requirements. This is an exclusive, online-only offer and is not valid for branch or phone account opens. There could be many reasons why you want to close your bank account. It's not uncommon for traditional banks to offer free checking accounts only for you to be slammed with hidden fees later on. Or for banks to promise high yields on investments and savings accounts, but then you realize the high fees that come with the high yield don't really make it worth it.

On the other hand, some banks just make it outright difficult for immigrants. Now you've found a better banking solution and want to get rid of the hassle. Employees also created fraudulent checking and savings accounts, a process that sometimes involved the movement of money out of legitimate accounts. The creation of these additional products was made possible in part through a process known as "pinning". By setting the client's PIN to "0000", bankers were able to control client accounts and were able to enroll them in programs such as online banking. Our overdraft fee for Consumer checking accounts is $35 per item ; our fee for returning items for non-sufficient funds is $35 per item.

We charge no more than three overdraft and/or non-sufficient funds fees per business day. Overdraft and/or non-sufficient funds fees are not applicable to Clear Access Banking℠ The payment of transactions into overdraft is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is overdrawn or you have had excessive overdrafts.

You must promptly bring your account to a positive balance. Wells Fargo provides a pretty well-rounded banking experience for its customers. You have a wide variety of bank accounts to choose from, alongside credit cards, auto loans and more. So whether you want a simple savings account, a Special CD or a checking account for your teenage daughter, you can find that here.

OnJuno's FDIC insured High Yield Checking Account can help you earn an industry-leading 1.20% on all deposits. No more anxiety of switching between checking and savings accounts. When it comes to determining what accounts will work for you, review your needs.

Do you need a way to set money aside for longer-term savings goals? Also, consider the proximity and availability of your bank's ATMs and branches, in addition to other personal preferences that may be important to you like online banking and overdraft protection. You can open this account jointly or individually, and you would need to provide some necessary information, driver's license, SSN , and minimum opening deposit.